2025 Review, 2026 Plan

- Note from the CIO

Some years exemplify the power of diversification. Others boast an “everything rally” where all asset classes shine. The year 2025 was both — a feat so rare I would be hard-pressed to come up with another example.

The U.S. stock market returned 17.2% in 2025, marking the sixth time in the past seven years it has delivered double-digit returns.1

What is most remarkable about this is not the volatility itself — though the market did suffer a 19% drop in the two months following its February 19th all-time high, 2 driven largely by the initial execution of the second Trump administration tariffs. No, what is truly remarkable is how distant that fear feels today. By April, the year was shaping up to be a major disappointment; the eventual double-digit positive outcome seemed unimaginable.

But we remember, and we imagine. The year 2025 serves as one of the best examples in memory that great returns and sharp declines are a “combo package”: you simply cannot get one without the other.

The Return of the Diversifiers

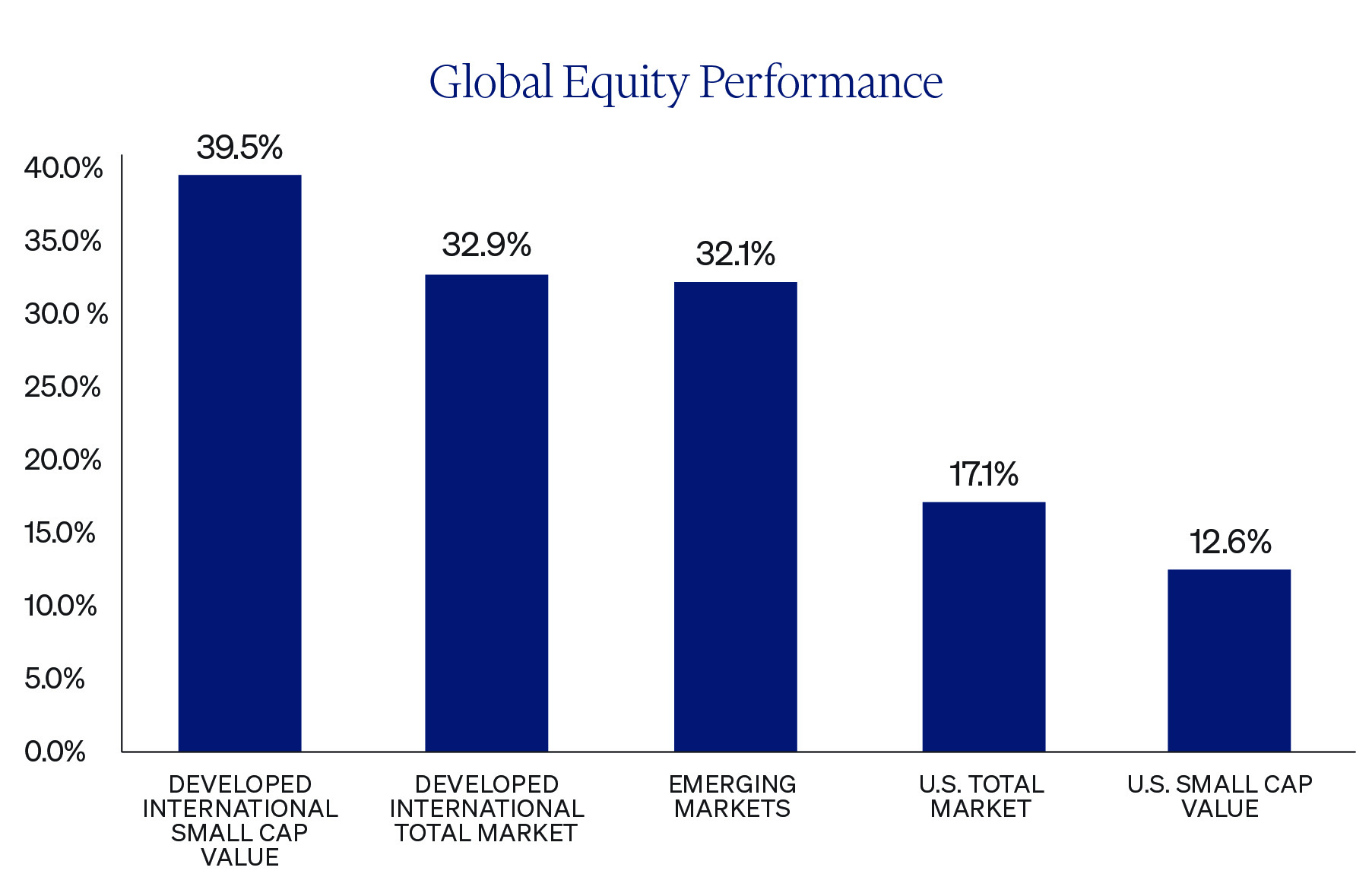

Notwithstanding the lesson on volatility, the investment highlight of the year was the return of the diversifiers. While U.S. stocks remained the largest allocation in most equity portfolios, we crucially surrounded this core with diversifying asset classes. Chief among these are non-U.S. stocks, and developed international stocks delivered an impressive 32.9% return last year.3

Now, the first question we should ask is: are these returns expressed in U.S. dollars? Throughout this note, they are. Given that, how much of the return was currency fluctuation versus the local stock market return?

As it happens, a basket of developed international currencies (including the euro, yen, pound, Canadian dollar, Swedish krona, and Swiss franc) appreciated 9% relative to the U.S. dollar over 2025.4 This confirms that the vast majority of the 32.9% return was indeed driven by the performance of the companies themselves.

However, this also implies the U.S. dollar depreciated 9% against that basket — its sharpest annual decline in 50 years. For some, this dollar depreciation was the bigger story, overshadowing stock performance. It signals mounting concern over U.S. economic fundamentals, such as the slowdown in new job creation, rising government debt, and trade policy uncertainty.

Emerging Markets & Small Value

Meanwhile, emerging market stocks performed nearly as well, delivering 32.1% for the year. This included South Korea, the top performer among the 40+ developed and emerging countries in our portfolios, with a return north of 93%.5 Interestingly, the South Korean won contributed only 2% to this total return, 6 which was driven heavily by the global boom in artificial intelligence.

In developed markets, we tilted slightly toward small company value stocks for their higher expected returns. In the U.S., small value stocks lagged the broader market, returning 12.6%. However, developed international small value stocks more than made up for this. They outperformed their broader market counterparts to become our top-performing equity asset class for the year, returning a whopping 39.5%.7

Looking Forward to 2026

As we look to 2026, we expect a continuation of recent themes. Many businesses will continue boosting productivity using artificial intelligence, while others will remain on the innovative forefront of this exponential technology. As this AI investment cycle reshapes markets, it will create both opportunities and concentration risks. Additionally, tariffs will likely continue as a policy tool, introducing a degree of arbitrariness that creates uncertainty for businesses and investors alike.

Specific events investors will be watching include:

- January: The expiration of the short-term budget bill and subsequent government funding negotiations.

- May: A likely change in the Federal Reserve Chair for the first time since 2018.

- November: Midterm elections — historically low-impact for markets but potentially significant politically.

- Interest Rates: An expectation by the majority of the FOMC of at least one more rate cut by year-end. 8

These are "known unknowns" — we are aware of the events but unaware of the outcomes. Markets will adjust daily to new information. While surprises happen, known unknowns generally do not drive markets significantly in either direction and should be of little concern to the multi-decade, goal-focused investor.

On a brighter note, the 2026 calendar offers reasons to celebrate: our nation’s quarter-millennium anniversary on July 4, and the supersized World Cup hosted across the U.S., Mexico, and Canada this summer.

Navigating the Unknown

Whatever big swings (volatility) we see in 2026 will ultimately be driven by unknown unknowns — events that catch us by surprise and are not priced into stock trajectories.

A repeated theme in these notes is that being surprised is natural and okay; how we react makes the difference. Reacting, especially emotionally, rarely works in investing. The time to act is always now, in advance of surprises, by maintaining an ultra-diversified mix of global companies, and enough bonds to ride out distress.

The Long View

Buttressed by a plan we continually act on, we expect innovation and wealth creation to help us reach our goals. We remain optimistic because of three powerful megatrends:

- The Spread of Freedom: The expansion of free markets that accelerated after the fall of the Berlin Wall continues to open economies today.

- The Rising Middle Class: According to the World Data Lab, over 300,000 people enter the global middle class every day,9 determined to improve their quality of life.

- Technological Transformation: Advances in information technology continue to fundamentally transform how we live and work.

These forces are larger than any single election or market cycle. By staying invested, we position ourselves to harness this global growth. Let’s stick to the plan and make 2026 another year of progress toward your goals.

- Dimensional Fund Advisors. The U.S. stock market is represented here by the Russell 3000 Index. ↩

- Daily index data: finance.yahoo.com/Russell3000 ↩

- Dimensional Fund Advisors. Developed international stocks are represented by the MSCI World ex USA IMI Index (gross div.) ↩

- Clearnomics, Inc., vis a vie Kitces.com/Blog/10 Charts to Help Explain the 2026 Market to Clients ↩

- Dimensional Fund Advisors. Emerging markets stocks are represented by the MSCI Emerging Markets IMI Index (gross div.) and South Korean stocks are represented by the MSCI Korea IMI Index (net div.). ↩

- fred.stlouisfed.org - South Korean Won to US Dollar Spot Exchange Rate ↩

- Dimensional Fund Advisors. U.S. small company value stocks are represented by the Russell 2000 Value Index and developed international small company value stocks are represented by the MSCI World ex USA Small Value Index (gross div.). ↩

- federalreserve.gov/Summary of Economic Projections data as of December 10, 2025, page 4 ↩

- Visual Capitalist (2024) “113 million people enter the middle class.” ↩

DISCLOSURE: Quantum Financial Advisors, LLC is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Quantum Financial Advisors, LLC by the SEC nor does it indicate that Quantum Financial Advisors, LLC has attained a particular level of skill or ability. This material prepared by Quantum Financial Advisors, LLC is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Advisory services are only offered to clients or prospective clients where Quantum Financial Advisors, LLC and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Quantum Financial Advisors, LLC unless a client service agreement is in place. This material is not intended to serve as personalized tax, legal, and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Quantum Financial Advisors, LLC is not an accounting or legal firm. Please consult with your tax and/or legal professional regarding your specific tax and/or legal situation when determining if any of the mentioned strategies are right for you.

Please Note: Quantum does not make any representations or warranties as to the accuracy, timeliness, suitability, and completeness, or relevance of any information prepared by an unaffiliated third party, whether linked to Quantum’s website or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

For more information about Quantum and this article, please read these important disclosures.

- Note from the CIO

Darius Gagne, PhD, CFP®, CFA

Darius Gagne is the Chief Investment Officer of Quantum Financial Advisors, LLC. Darius is also a Financial Advisor directly to clients and a founding partner of the firm.

Read More