25 Years and Seven Panics: The Perfect Laboratory

- Note from the CIO

- Investment Management

A friend recently expressed concern about a potential market correction later this year. Of course, no one can predict the future with certainty — not me, not anyone else. So rather than debating an unknowable outcome, let’s instead assume he’s not only right but that the market is heading for a 50% drop. Then, let’s say seven years later the market drops again, but even more than 50%. Finally, let’s assume we endure in total seven distinct market panics over the next 25 years.

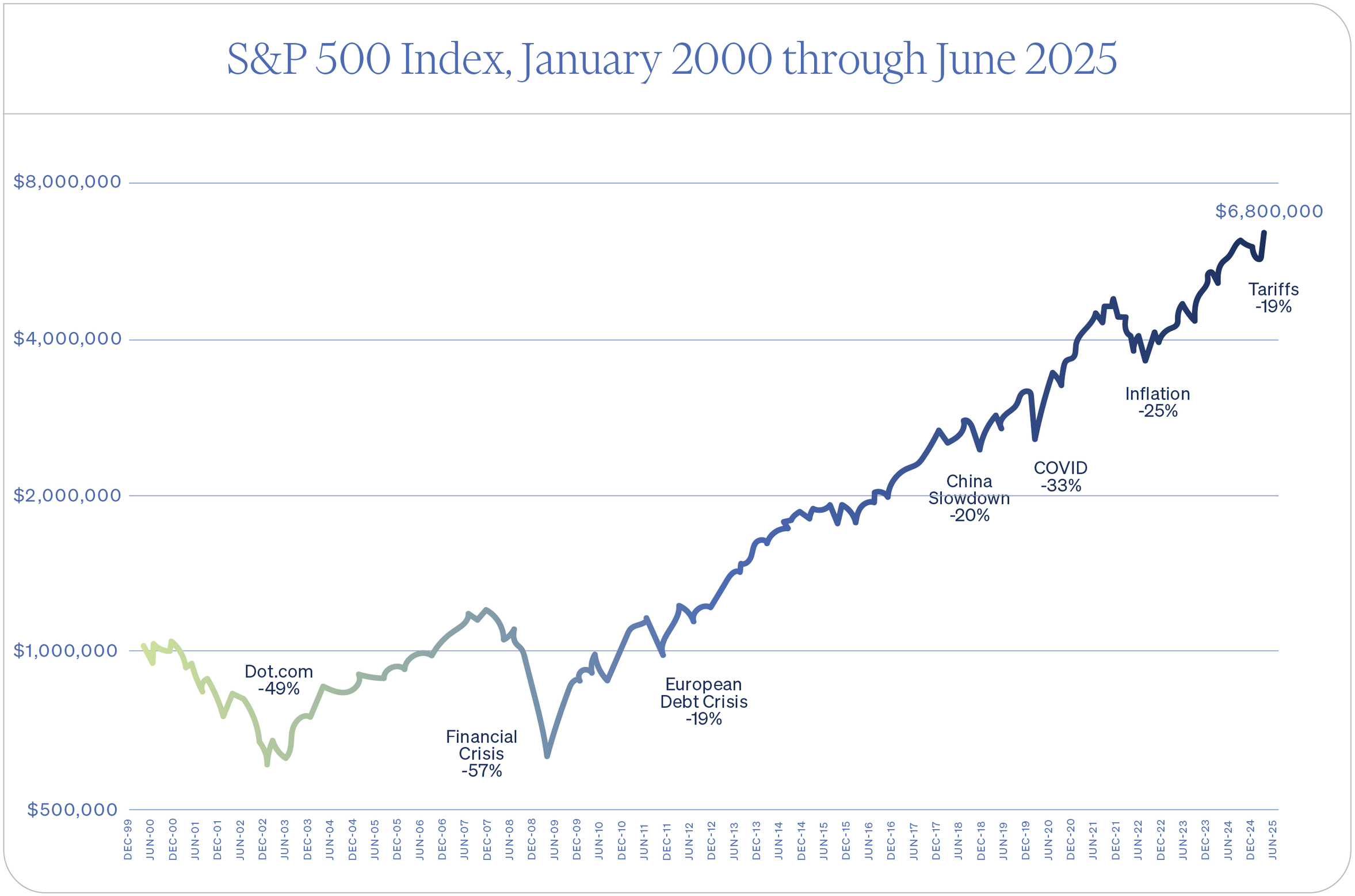

If that sounds extreme, consider this: the past 25 years delivered exactly that. The first quarter century of this millennium has been an extraordinary laboratory for testing — and validating — our investment philosophy. Here is that period and its seven market panics, illustrated in a single chart:

Let’s briefly review each of these episodes:

Dot-com Bust, 9/11, Iraq War, Enron Scandal (2000–2002)

After the greatest bull market in U.S. history, especially in tech, the stock market began to collapse under inflated valuations shortly after the turn of the century. The 2001 terrorist attacks and the subsequent Iraq War compounded the fear in the markets. Then came the downfall of Enron and Arthur Andersen in an accounting scandal. The result? A 49% drop over two and a half years — the worst since the Great Depression.

Global Financial Crisis (2007–2009)

Etched in the psyche of investors, the collapse of the U.S. housing bubble propped up by subprime mortgages led to a chain reaction that is almost too difficult to recount: Bear Stearns collapsed, mortgage giants Fannie Mae and Freddie Mac were seized, Lehman Brothers filed bankruptcy, and AIG required a massive bailout. At one point, the global credit system froze. The market plummeted 57%, bottoming in early 2009 before launching a historic recovery.

European Debt Crisis, U.S. Debt Downgrade, Government Shutdown (2011)

In 2011, fears of sovereign defaults in Europe, a downgrade of U.S. credit, and political gridlock led to a 19% correction (22% intraday). For investors still traumatized from 2008, this trifecta felt like history repeating itself.

China Slowdown and Tariffs 1.0 (2018)

Over the 2018 holiday season, markets completed a 20% drop amid slowing Chinese growth and initial U.S. trade tariffs under the first Trump presidency. The bear market came quickly and left as quickly as policy softened.

COVID Pandemic (2020)

A 33% crash in barely a month occurred as the world locked down in response to the worst pandemic in a century. Remarkably, massive stimulus and central bank support powered markets to close the year with strong gains. By then the U.S. had experienced its most severe recession since the Great Depression.

Inflation Spike (2022)

After many years of low inflation, the Consumer Price Index surged to 9% following pandemic-era stimulus and supply chain disruptions. Markets fell by 25% that year as interest rates rose sharply.

Tariff Tornado (2025)

A market already retreating from February highs plunged further after President Trump’s “Liberation Day” tariff announcement in April. Markets priced in a potential trade war, resulting in a 19% decline (21% intraday). Relief followed when a 90-day postponement was announced, helping the index quickly recover to new highs. Economist Scott Lincicome1 notes that American companies have been pretty phenomenal about front-running the tariffs: boosting their inventories, readjusting supply chains, and finding creative ways to defer the tariffs. And as I have pointed out in past notes, we are ultimately invested in companies, not countries or governments.

There you have it — seven panics in 25 years. Yet the S&P 500 companies today stand 6.8 times higher than they did in 2000 (with dividends reinvested). What can we learn from this?

- Timing these events was nearly impossible — and more importantly, completely unnecessary for the goal-focused, plan-driven investor. With a sound, risk-managed plan in place, the wisest course was to ride out even the worst downturns.

- Each panic was different in cause and character — but identical in outcome: a full recovery and ultimately, new market highs.

- The real risk isn’t that investors experience downturns — it’s that they miss the recoveries, which have consistently outweighed the declines.

We can’t know what the next 25 years will bring. But what we do know is this: Our investment philosophy has been stress-tested through seven major panics. It held strong — and rewarded those who stayed the course.

DISCLOSURE: Quantum Financial Advisors, LLC is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Quantum Financial Advisors, LLC by the SEC nor does it indicate that Quantum Financial Advisors, LLC has attained a particular level of skill or ability. This material prepared by Quantum Financial Advisors, LLC is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Advisory services are only offered to clients or prospective clients where Quantum Financial Advisors, LLC and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Quantum Financial Advisors, LLC unless a client service agreement is in place. This material is not intended to serve as personalized tax, legal, and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Quantum Financial Advisors, LLC is not an accounting or legal firm. Please consult with your tax and/or legal professional regarding your specific tax and/or legal situation when determining if any of the mentioned strategies are right for you.

Please Note: Quantum does not make any representations or warranties as to the accuracy, timeliness, suitability, and completeness, or relevance of any information prepared by an unaffiliated third party, whether linked to Quantum’s website or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

For more information about Quantum and this article, please read these important disclosures.

- Note from the CIO

- Investment Management

Darius Gagne, PhD, CFP®, CFA

Darius Gagne is the Chief Investment Officer of Quantum Financial Advisors, LLC. Darius is also a Financial Advisor directly to clients and a founding partner of the firm.

Read More