The Necessity of Uncertainty

- Note from the CIO

- Investment Management

The second quarter of 2024 brought market movements that served as an excellent reminder of the randomness and unpredictability of financial markets. In July, the unwinding of a popular investment strategy among active investors known as a carry trade caused global markets to drop 8% in two weeks only to reach new peaks in the following three weeks. September brought more volatility as investors eagerly anticipated a decision by the Federal Reserve to cut the Federal Funds rate for the first time since March of 2020 given signs of cooling inflation and tightening in the labor market. During this time, the S&P 500 dipped over 4% in the first week of September and then fully recovered just days before the Fed’s September meeting.

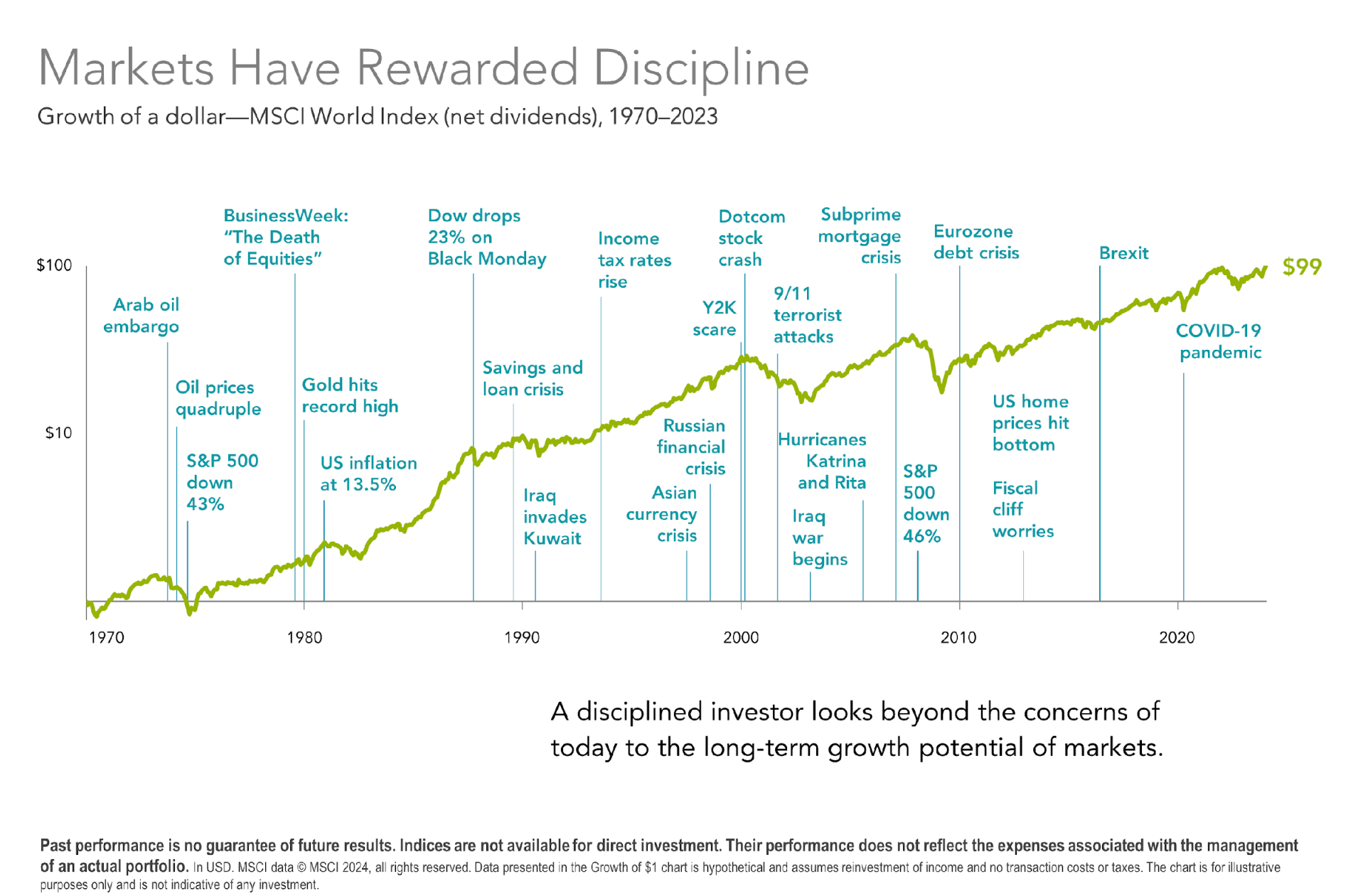

These events remind us that stock market declines can happen for countless reasons, as seen in the chart below, and are a normal - in fact, a necessary - part of the market cycle. Market downturns can be unnerving and can spook investors in the moment, creating the urge to sell in a panic after seeing the value of their portfolios drop so quickly. However, the goal-focused, long-term investor can view volatility with detached curiosity and take comfort in the fact that 1) their financial plan accounts for the possibility of these events with a sufficient buffer of bonds for those withdrawing from their portfolio, 2) their dividends will be reinvested in lower priced shares, and 3) for those still adding to their portfolio, their savings will also be invested in lower priced shares. In the end, do these temporary declines matter for a 30-year investment plan tailored to match an investor’s financial goals? If history is any indication, they probably do not.

The randomness of short-term volatility creates uncertainty for investors in stocks. Uncertainty is a risk for investors, but it is only with risk that investors are rewarded. If all investment outcomes could be predicted with perfect accuracy, investors would only earn the risk-free rate of return. With lower investment returns, future goals would be more expensive to fund and save for in the present. So, with a long-term orientation, investors can take advantage of the returns earned by taking on market risk.

Looking ahead, investors face more uncertainty as the presidential election looms, with the result having important implications for policy and governance. However, history has shown that the US stock market has appreciated steadily over the long term regardless of which party is in power. The key takeaway for investors is to focus on the long term. Companies will continue to compete and innovate to earn profits and protect shareholder wealth, consumers will continue to want more and more goods and services, and investors can benefit by staying in their seats no matter who is elected president.

Uncertainty creates opportunity. A goal-oriented, long-term investor does not wish for uncertainty to disappear, but rather takes advantage of the opportunity that uncertainty creates. Riding out the valleys and troughs that the market experiences from time to time are a necessary price to pay – and really, all that is required -- for achieving equity returns over the course of an investment lifetime.

DISCLOSURE: Quantum Financial Advisors, LLC is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Quantum Financial Advisors, LLC by the SEC nor does it indicate that Quantum Financial Advisors, LLC has attained a particular level of skill or ability. This material prepared by Quantum Financial Advisors, LLC is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Advisory services are only offered to clients or prospective clients where Quantum Financial Advisors, LLC and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Quantum Financial Advisors, LLC unless a client service agreement is in place. This material is not intended to serve as personalized tax, legal, and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Quantum Financial Advisors, LLC is not an accounting or legal firm. Please consult with your tax and/or legal professional regarding your specific tax and/or legal situation when determining if any of the mentioned strategies are right for you.

Please Note: Quantum does not make any representations or warranties as to the accuracy, timeliness, suitability, and completeness, or relevance of any information prepared by an unaffiliated third party, whether linked to Quantum’s website or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

For more information about Quantum and this article, please read these important disclosures.

- Note from the CIO

- Investment Management

Ryan Balderian, CFA®

Ryan Balderian is the Director of Investments and Trading of Quantum Financial Advisors, LLC.

Read More