Did That Just Happen?

- Note from the CIO

- Investment Management

The first half of 2023 was an unending test of nerves for investors. Those who practiced time-tested investment principles were in a good position to benefit from the recovery in the markets, a welcome turn from last year’s broad declines.

Throughout the first six months of this year, we continued to deal with higher-than-average inflation, but the trend for the year-over-year increase has moved steadily in the right direction since its peak at 9.1% in June of last year. The most recent annual inflation number through June of this year has dropped to 3.0% and is now the same as the long-standing assumption for general inflation used by our advisors in client financial plans. The 5.4% yield on treasury notes over the next 12 months suggests that even the most conservative investment is likely to beat inflation, a good sign that the problem is closer to being under control. Fed officials paused on raising the benchmark federal funds rate in June 2023, after more than a year of increases, but signaled they were leaning toward resuming rate increases if inflation doesn’t cool further.

After months of rapid interest rate increases, the Federal Reserve may have obtained more than they bargained for in the banking sector. This year we witnessed three of the four largest bank failures on record (after Washington Mutual in 2008), including Silicon Valley Bank. Many wondered if this was the start of another financial crisis. At this point, however, it appears the contagion has been contained to these banks, which were highly exposed to the high-tech sector, an especially interest-rate sensitive part of the economy.

We also dealt with the debt limit saga. Although our position was that the risk of a US default on Treasury bonds was exaggerated, the tension could not be ignored. After much back-and-forth, the president and Congress agreed on a deal to raise the debt limit in return for restraints on government spending for two years.

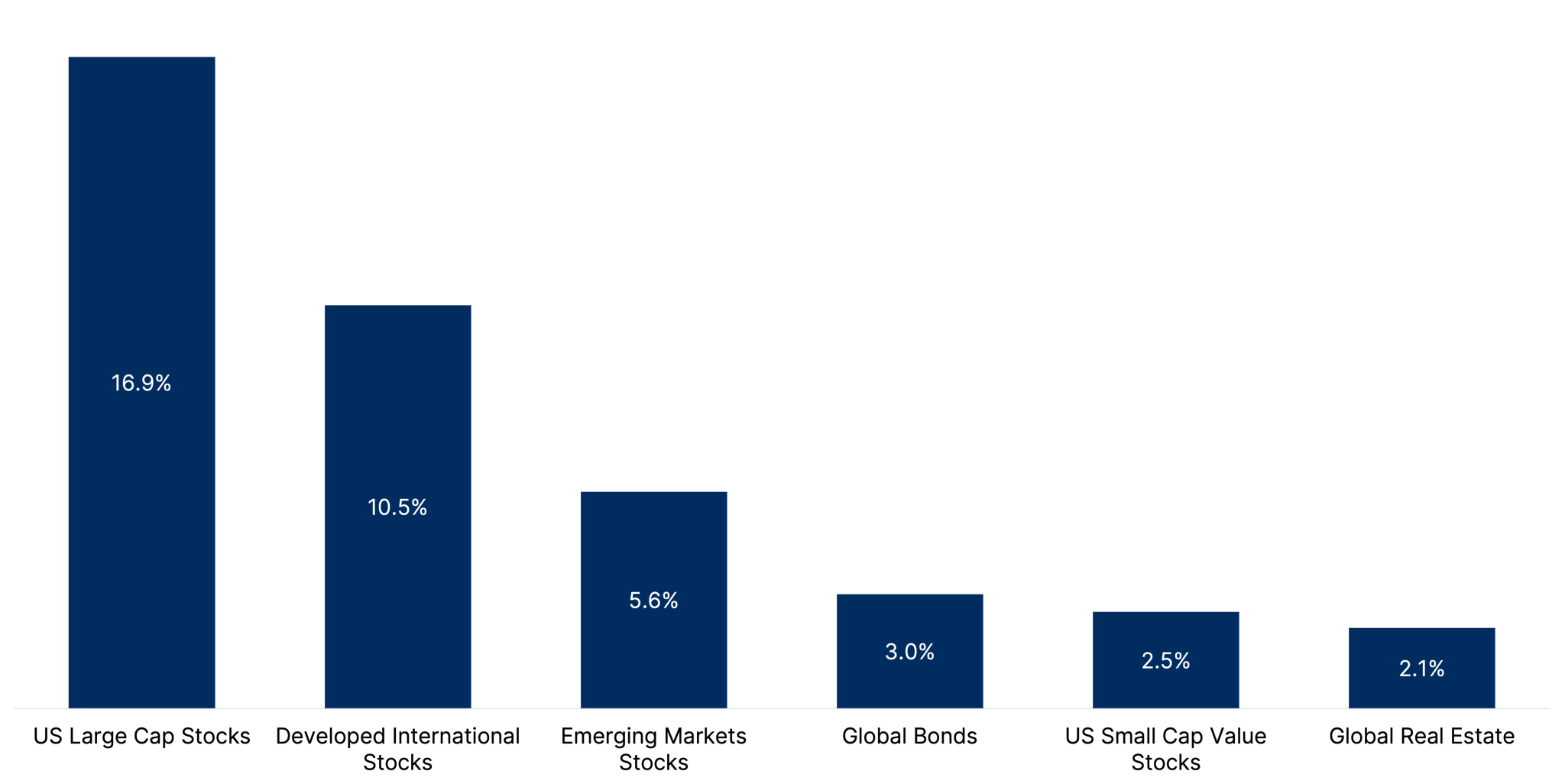

Asset classes enjoyed a rebound in the first half of the year, following the worst year for stocks since the 2008 financial crisis and the worst year for bonds in four decades. US stocks led the pack, earning 16.9% over the six months. International stock markets also bounced back after posting their worst year since the financial crisis, with developed and emerging markets earning 10.5% and 5.6% respectively. Global real estate lagged the group at 2.1%.

Small value stocks started the year off ahead of the group, continuing their streak from last year. But eventually the rise in interest rates hit a level that curbed their advance, as the value of smaller companies is more sensitive to interest rate movements than that of larger companies. At the same time, larger companies were fueled by increased attention on artificial intelligence and its potential. Much of the stock market’s gain can be attributed to just a handful of companies, led by NVIDIA, which saw strong chip sales as interest in AI built.

Artificial Intelligence

Some are asking how AI can be used in investing. The first thing to know is that although AI is an excellent aggregator of data, there’s no reason to think it offers investors predictive capabilities. The other important thing to know is that we investors have had the world’s largest information-processing machine on our side for decades: the market, which processes all available information almost instantaneously, building that information into the prices of stocks and bonds. Further, markets are forward-looking, reflecting investors’ best estimate of an asset’s value in relation to future expected cash flows.

Peter Lynch, who managed the Magellan Fund, said, “The real key to making money in stocks is not to get scared out of them.” It is in that sense that these past six months represent for our clients a microcosm of a successful lifetime of investing. Amid all the pessimism, they kept working their plans and didn’t engage in panic selling. Congratulations to all of you, clients or not, who stood by time-tested investment principles this year, even when our patience and discipline was tested. Is it possible that a lifetime of successful investing is just that simple? We certainly believe it can be and hope you do too.

DISCLOSURE: Quantum Financial Advisors, LLC is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Quantum Financial Advisors, LLC by the SEC nor does it indicate that Quantum Financial Advisors, LLC has attained a particular level of skill or ability. This material prepared by Quantum Financial Advisors, LLC is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Advisory services are only offered to clients or prospective clients where Quantum Financial Advisors, LLC and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Quantum Financial Advisors, LLC unless a client service agreement is in place. This material is not intended to serve as personalized tax, legal, and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Quantum Financial Advisors, LLC is not an accounting or legal firm. Please consult with your tax and/or legal professional regarding your specific tax and/or legal situation when determining if any of the mentioned strategies are right for you.

Please Note: Quantum does not make any representations or warranties as to the accuracy, timeliness, suitability, and completeness, or relevance of any information prepared by an unaffiliated third party, whether linked to Quantum’s website or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

For more information about Quantum and this article, please read these important disclosures.

- Note from the CIO

- Investment Management

Darius Gagne, PhD, CFP®, CFA

Darius Gagne is the Chief Investment Officer of Quantum Financial Advisors, LLC. Darius is also a Financial Advisor directly to clients and a founding partner of the firm.

Read More