Updates and Principles

- Note from the CIO

- Investment Management

Market Updates

- Stocks across the globe returned about 6.1% in the first quarter of 2023 (“Q1”).1

- Global stocks are still down from their high at the start of 2022, namely by 9.0% through the end of Q1. That is a welcomed improvement however, as these stocks were down by as much as 21% from the same high through the end of last September.

- But it is important to maintain a longer-term perspective, which in this case only means looking back five years, over which time these same global stocks earned 6.8% per year on average through Q1 despite the drop we experienced last year, not to mention the more significant drop experienced because of COVID in 2020.

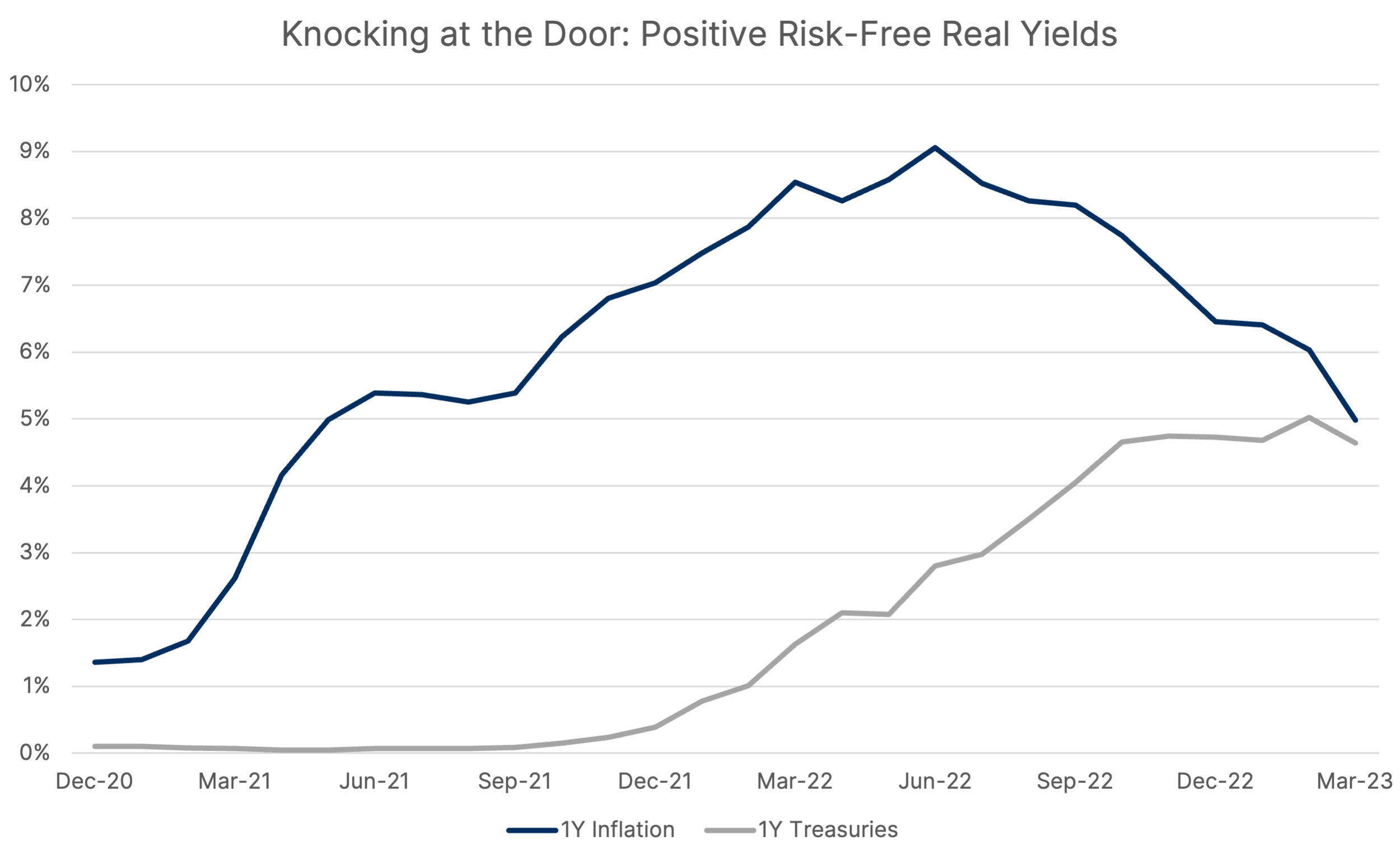

- The battle against inflation has nearly reached another positive turning point. Take a look at this chart:

The first positive turning point was when inflation began steadily declining from its 40-year high of 9.1%. But another has nearly occurred at the end of Q1 when the yield on one-year US Treasury bills almost exceeded inflation.2 Even the safest one-year investment on the planet needs to earn a return above inflation (known as a positive “real return”) in order for the economy and markets to function in a healthy and sustainable way. Given the pace at which inflation has been declining recently and the fact that all but one Federal Reserve official now projects that there will be at least one more interest rate hike this year, the crossing of these two curves seems likely in the months or quarters ahead.

The last time that we saw such a reduction in inflation, with Treasury bills reclaiming a positive real yield versus inflation, was in 1982. On that occasion, the S&P 500 tripled in value over the subsequent five years. That could have just been a coincidence, and as conservative financial planners, we don’t count on history repeating itself, but it is an encouraging historical reminder that over time, remaining committed to a well-diversified portfolio generally yields favorable results.

Quantum Portfolio Updates

After an extensive period of research, discussion, and debate, we are pleased to announce that the Investment Committee (“IC”) at Quantum has updated the allocations of the equity (stocks and real estate) portion of our client portfolios. What I would like to share here is a reminder of the underlying investment principles used at Quantum that guide our IC and our advisors as we provide portfolio design and advice for clients.

Quantum Investment Principles

- Planning Leads to Success. Successful investors are goal-focused and planning-driven, while unsuccessful investors are market-focused and performance-driven.

- Forecasting & Timing Lead to Regret. The economy cannot be consistently forecasted, nor the markets consistently timed.

- Temperament Outweighs All Else. The essential challenge to successful investing is neither intellectual nor financial, but temperamental: it is how one reacts, or chooses not to react, to events and the consistency with which one continues to act on a plan.

- Benchmarking with Goals. The only benchmark that ultimately matters is the one that tells you whether you are on track to reach your goals.

- Goal-Matching. A cornerstone of any investment plan uses bonds for short-term goals and equities (stocks and real estate) for long-term goals. The distinction between short-term and long-term depends on the investor’s goal and tolerance for uncertainty.

- Declines are Temporary. Investing in equities means having to endure frequent but temporary sharp declines to capture their premium returns over time. The only reliable way to capture the full return of equities is to maintain continuous ownership.

- Total Market Diversification. Equity investing captures the financial benefits of innovation and ingenuity. But it is impossible to predict in advance which companies, or even which countries will create the most value over any period of time. Therefore, we do not stock-pick but rather invest in the total global equity markets that include roughly 10,000 companies across 44 countries to capture the totality of human productivity.

- Dangers of Stock Picking. Research on the performance of investors who pick stocks shows that those who happen to outperform the market over a period of time most likely underperform over the next similar period of time. This suggests that picking winning stocks is more luck than skill.

- Dimensions of Higher Expected Return. There are dimensions of higher expected returns amongst stocks. Small companies have a higher expected return (and therefore more risk) than large companies. Low-priced companies, or “value” stocks, have a higher expected return than high-priced companies, or “growth” stocks. High-profit companies have a higher expected return than low-profit companies.

In the coming quarters, I will elaborate on various principles in more detail. In the meantime, your advisor would welcome the opportunity to discuss them as well.

- This is based on the allocation of global stock investments used by Quantum. Global equity mixes across client accounts ranged from 6.1% to 6.5% depending on specific funds used. ↩

- We are using here the yield on US Treasury bills that will be earned in the next 12 months (if held to maturity), so “forward-looking,” while the inflation rate refers to the change in prices (of goods and services) over the past 12 months, so “backward-looking.” ↩

DISCLOSURE: Quantum Financial Advisors, LLC is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Quantum Financial Advisors, LLC by the SEC nor does it indicate that Quantum Financial Advisors, LLC has attained a particular level of skill or ability. This material prepared by Quantum Financial Advisors, LLC is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Advisory services are only offered to clients or prospective clients where Quantum Financial Advisors, LLC and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Quantum Financial Advisors, LLC unless a client service agreement is in place. This material is not intended to serve as personalized tax, legal, and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Quantum Financial Advisors, LLC is not an accounting or legal firm. Please consult with your tax and/or legal professional regarding your specific tax and/or legal situation when determining if any of the mentioned strategies are right for you.

Please Note: Quantum does not make any representations or warranties as to the accuracy, timeliness, suitability, and completeness, or relevance of any information prepared by an unaffiliated third party, whether linked to Quantum’s website or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

For more information about Quantum and this article, please read these important disclosures.

- Note from the CIO

- Investment Management

Darius Gagne, PhD, CFP®, CFA

Darius Gagne is the Chief Investment Officer of Quantum Financial Advisors, LLC. Darius is also a Financial Advisor directly to clients and a founding partner of the firm.

Read More