Logically Speaking: How Your Financial Plan Helps You Stay Steady During Market Volatility

- Financial Planning

- Investment Management

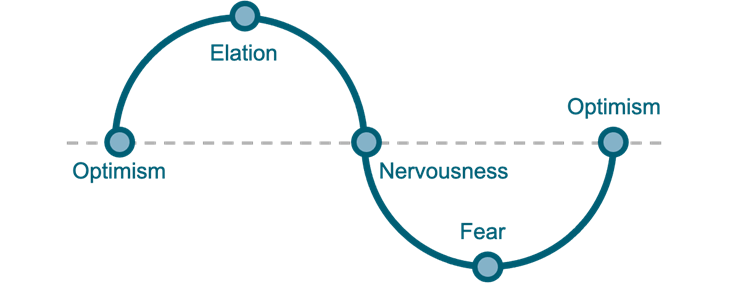

Investing is often thought of as an analytical endeavor: calculating investment performance, studying company financial reports, parsing through reams of economic data, and making investments using data and logic. However, many people fail to recognize the role emotions play in their investment decisions. The stock market moves in wave-like cycles, and these movements up and down stimulate emotions, much like a roller coaster ride can, ranging from elation to fear as shown in the diagram below. These emotions can cause investors to make decisions that studies have shown to adversely affect their investment outcomes. Whether investors recognize it or not, their emotions and, more importantly, how they react to those emotions play a crucial role in determining their investment results. The good news is that a planning-focused, goal-driven financial plan can help mitigate these decision-making errors by providing tools to overcome these emotionally charged moments.

Financial Fear

It is normal for investors to experience fear even before they make their first investment in the stock market. Oftentimes, this fear stems from the fear of making a mistake that results in losing their hard-earned money. In fact, behavioral economists, who study the role of emotions in financial decision-making, have found that a loss produces twice as much pain psychologically as the pleasure produced by an equivalent gain. Known as loss-aversion, when potential investors perceive the possibility of loss as more significant than the opportunity for gain, they may never start to invest missing out on the chance to enjoy compound returns. Loss aversion can also cause investors to sell at an inopportune time such as a market downturn, locking in the loss and missing a prime buying opportunity. Media coverage can also amplify fear in investors and cause them to sell in a panic to avoid further losses (which actually may never come to fruition).

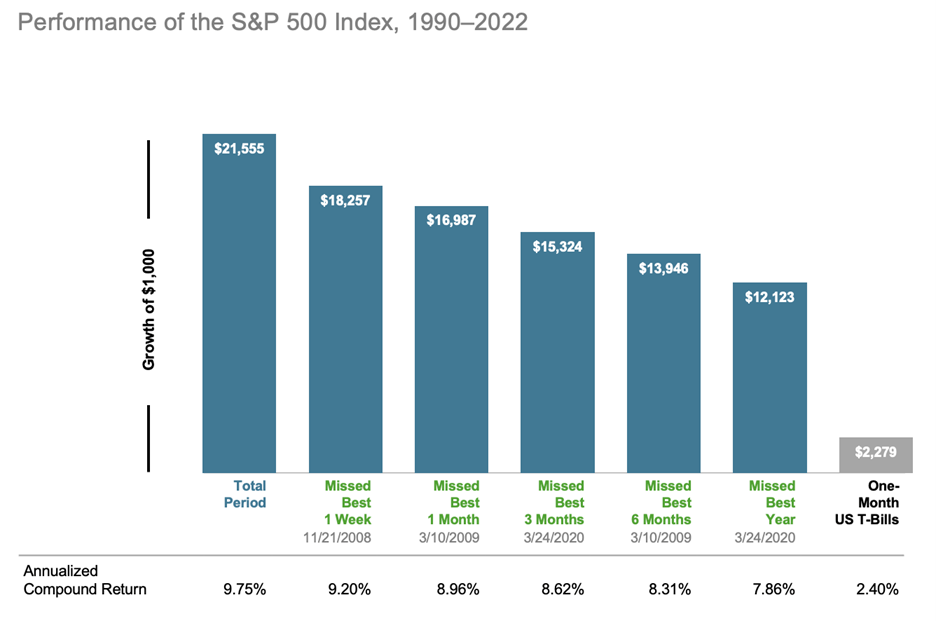

Both scenarios described above can cause investors to unnecessarily miss out on investment returns. The chart below shows that an investor starting with $1,000 in 1990 and continually staying invested in the S&P 500, an index consisting of 500 of the largest US companies, until 2022 would obtain a final balance of $21,555. The chart also shows the consequences of missing the strongest 1 week, 1 month, and 3 – 12 month periods from 1990 to 2022. As shown below, if an investor missed only the best 1 week period, their portfolio would be a full 15% lower at $18,257. And that investor was only out of the market for less than 0.1% of the period!

Greed – The other side of Fear

The fear investors face during market downturns can quickly shift into greed during market rallies as shown in the optimism to elation curve in the diagram above. This isn’t to say that all investors morph into versions of Ebenezer Scrooge or Gordon Gekko1 , but the fact is that a strong rally in the stock market can make investors feel that profits are easy to come by, and as a result, they could end up investing more heavily in risky stocks or taking on more risk than is appropriate for their situation. For example, an investor driven by greed and overconfidence may invest the capital they set aside for the down payment on a home thinking they can make a “quick profit”, potentially derailing their home purchase.

A solid financial plan, one that Is designed to accomplish the goals of the investor while minimizing the probability of failure, is built on proven investment principles, such as broad diversification and taking appropriate levels of assessed risks. This gives the long-term, goal-oriented investor courage to stay invested even in the face of steep declines.

Emotions are vital to the human experience and are a key tool in our survival. Optimism and hope fuel action for a better future, and fear keeps us safe from danger. But investing with knee-jerk reactions based on emotions often leads to suboptimal results. By having a strong financial plan and a financial planner to provide accountability and coaching along the way, an investor is better equipped to face panic-inducing fear or reject seductive greed with the confidence that their financial plan is suited to their goals. At Quantum, we believe that a successful investment strategy is based on a goal-driven financial plan that helps you manage your emotions through the ups and downs of the market by ensuring coverage of your essential needs while staying focused on reaching your long-term goals.

- Gordon Gekko is the financier played by Michael Douglas in the 1987 film Wall Street that made famous the phrase “Greed is Good.” ↩

DISCLOSURE: Quantum Financial Advisors, LLC is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Quantum Financial Advisors, LLC by the SEC nor does it indicate that Quantum Financial Advisors, LLC has attained a particular level of skill or ability. This material prepared by Quantum Financial Advisors, LLC is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Advisory services are only offered to clients or prospective clients where Quantum Financial Advisors, LLC and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Quantum Financial Advisors, LLC unless a client service agreement is in place. This material is not intended to serve as personalized tax, legal, and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Quantum Financial Advisors, LLC is not an accounting or legal firm. Please consult with your tax and/or legal professional regarding your specific tax and/or legal situation when determining if any of the mentioned strategies are right for you.

Please Note: Quantum does not make any representations or warranties as to the accuracy, timeliness, suitability, and completeness, or relevance of any information prepared by an unaffiliated third party, whether linked to Quantum’s website or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

For more information about Quantum and this article, please read these important disclosures.

- Financial Planning

- Investment Management

Ryan Balderian, CFA®

Ryan Balderian is the Director of Investments and Trading of Quantum Financial Advisors, LLC.

Read More