SECURE 2.0, and Your Financial Resolutions for 2024

- Tax Planning

In 2019, Congress passed the Setting Every Community Up for Retirement Enhancement (SECURE) Act, which brought big changes to the laws governing retirement accounts, including an easier path for small businesses to offer company-sponsored retirement plans to their employees, a higher age for required minimum distributions (RMDs) for certain retirement plans, and more. Then, in 2022, Congress passed a “sequel”: SECURE 2.0. In addition to the revisions in retirement plans enacted by the previous act, SECURE 2.0 allowed many persons to delay their RMDs even later, eliminated RMDs for Roth 401(k) accounts, and other changes.

With all the new changes, it’s possible that you should be taking a fresh look at some of your financial resolutions for 2024. Let’s examine a few that could make a difference in the coming year.

1. IRA catch-ups indexed to inflation

If you are 50 or older and making catch-up contributions to your IRA account, up to now you’ve been limited to $1,000 per year over the standard maximum contribution. But starting in 2024, SECURE 2.0 will index the allowed catch-up contribution to inflation, which means that you may be able to boost your catch-up contributions, allowing you to grow your IRA even faster.

2. Roth 401(k)s and Roth 403(b)s exempt from RMDs

Previously, if you participated in an employer-sponsored retirement plan (typically, a 401(k) in a for-profit company, and a 403(b) for nonprofit enterprises like schools and hospitals), you were still required to take required minimum distributions from a Roth account when you reached the applicable RMD age, unless you were still working and did not own more than 5% of the company. However, starting in 2024, RMDs are no longer required for these qualified, employer-sponsored plans in designated Roth accounts. While you can still take withdrawals from the account if you wish, the ability to continue deferring them gives account owners more flexibility over the sources of their retirement income. In certain cases, it may be more advantageous to draw down from taxable sources first, before taking withdrawals from tax-advantaged (or, in the case of Roth accounts, tax-free) sources. If this new rule applies to you, it may be important for you to consult with your Quantum advisor to determine the best “draw-down” strategy for your situation.

3. Higher ages for RMDs

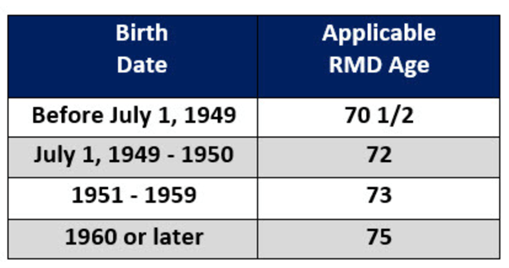

In past years, owners of traditional IRAs, 401(k)s, and 403(b)s were required to begin taking required minimum distributions (RMDs) from their accounts beginning at age 70 ½. The 2019 SECURE Act raised the age to 72. Now, under the new rules, most account owners are not required to begin taking RMDs until age 73. After that, the law progressively moves the required age higher year by year, until it reaches the maximum of age 75.

If these new age limits apply to you, you may wish to consult with your tax and Quantum advisors to determine if delaying your RMDs would be advantageous for you. Also note that the new law took effect in 2023, and it does not apply to account holders born in 1950 or earlier who had RMDs due in 2022 or previous years; they must continue to take their RMDs according to IRS guidelines.

4. Decreased penalty for missed RMDs

If the above paragraph seems confusing, there’s a small ray of hope: SECURE 2.0 also decreased the penalty for persons who fail to take an RMD on schedule. Formerly, if you failed to take your RMD in a timely manner, the penalty due to the IRS was 50% of the amount of the RMD, but SECURE 2.0 reduced the penalty to 25%, and possibly 10%, “if the RMD is timely corrected within two years.” Of course, just because the penalty has been reduced doesn’t mean that you shouldn’t exercise the same care and planning to make sure that you take the proper amount each year. The bottom line is that if you are taking or plan to begin taking RMDs, you should consult with your Quantum advisor to make sure that you are compliant with IRS requirements.

5. No more “stretch rule” for inherited IRAs

Prior to the SECURE Act, a non-spousal heir (typically, a child or grandchild) could receive an IRA as a bequest and take distributions from the account spread over their entire life expectancy. Obviously, this was advantageous when significant amounts were involved, as it gave the beneficiary the option to “spread” the impact of the taxable income from the IRA distributions over a longer period of time, minimizing the tax impact for any given year. However, the SECURE Act changed all that; non-spousal beneficiaries of an IRA account must now take distribution of the entire account within 10 years of receipt. There are a few exceptions to this rule:

- Chronically ill or disabled non-spousal beneficiaries;

- Non-spousal beneficiaries who are within 10 years of the same age as the deceased account holder;

- Minor children of the deceased account holder—however, this only applies until the child reaches age 21. At that time, they must fully distribute the account within 10 years.

Persons who have inherited IRAs should certainly consult with their tax and Quantum advisor, as these rules and exceptions are subject to change.

As always, Quantum is dedicated to keeping you well-informed and providing guidance that is always delivered with your best interests foremost. To learn more about "How We Serve," please visit our website.

DISCLOSURE: Quantum Financial Advisors, LLC is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Quantum Financial Advisors, LLC by the SEC nor does it indicate that Quantum Financial Advisors, LLC has attained a particular level of skill or ability. This material prepared by Quantum Financial Advisors, LLC is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Advisory services are only offered to clients or prospective clients where Quantum Financial Advisors, LLC and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Quantum Financial Advisors, LLC unless a client service agreement is in place. This material is not intended to serve as personalized tax, legal, and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Quantum Financial Advisors, LLC is not an accounting or legal firm. Please consult with your tax and/or legal professional regarding your specific tax and/or legal situation when determining if any of the mentioned strategies are right for you.

Please Note: Quantum does not make any representations or warranties as to the accuracy, timeliness, suitability, and completeness, or relevance of any information prepared by an unaffiliated third party, whether linked to Quantum’s website or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

For more information about Quantum and this article, please read these important disclosures.

- Tax Planning