Year-End Tax Strategies

- Financial Planning

- Tax Planning

- Executive Compensation

As 2023 winds down, individuals and businesses alike are turning their attention to year-end tax planning to optimize their financial situations. With the right timing and understanding, you may be able to reduce the size of the check you’ll have to write to the Treasury Department next April. In this article, we will explore key tax planning strategies and provide insights into what to expect in 2024.

Review Your Strategy for Stock Based Awards

If you’ve received restricted stock units (RSUs) or restricted stock awards (RSAs), do you have a strategy or plan in place for when to sell or transfer the shares? In keeping with the well-known accounting maxim, “Defer income, accelerate deductions,” you may want to hold off on recognizing the value of these holdings until after the first of the year, especially if selling now and generating a significant capital gain would bump you into a higher marginal bracket.

And as for the deduction side, if you are holding vested units that you have had for more than a year, you may have an excellent opportunity to make a meaningful gift to a favorite charity—and generate a sizeable deduction at the same time. There are a couple of ways you can do this.

- Direct gift. You can gift the assets directly to the charity of your choice. The charity receives the benefit of the full market value, instead of the after-tax value, and as the donor, you obtain an income tax deduction for the market value of the shares, up to 30% of your adjusted gross income (AGI). The limit for cash gifts increase to 60% of your AGI. Further, any excess that cannot be deducted in the year of the contribution can be carried forward for five years.

- Donor-advised fund (DAF). By utilizing a DAF, you can contribute appreciated assets to the fund and then direct gifts from the fund to a qualified charity or charities of your choice on your own schedule. DAFs can typically receive various types of assets, including appreciated stock, real estate, and others. When you make a contribution to the DAF, you receive a charitable deduction and at the same time avoid recognition of a capital gain. A double tax benefit!

Either of these methods can provide two benefits: a helpful deduction from taxable income, and a benefit to a worthy cause. If you think you may be able to take advantage of these strategies, you should consult with your tax professional or Quantum advisor to make sure it makes sense for you.

Strategies for Business Owners

Business owners who anticipate making major machinery or equipment purchases in the coming months may wish to consider accelerating their timeframe into the current year. By utilizing the Section 179 deductions instead of capitalizing the purchase and putting it on a depreciation schedule, they may be able to reduce taxable income for 2023. Keep in mind that the equipment must be placed in service in the year for which you take the deduction. The maximum amount available for deduction in 2023 is $1.16 million.

This is the perfect time of year to re-examine options for retirement accounts. In addition to traditional 401(k) plans, business owners with high incomes may do well to consider defined benefit plans or cash balance plans to accelerate contributions.

Owners of businesses with no employees (“solo-preneurs”) can set up solo 401(k) plans. Note that if the business is organized as an S-Corp or personal service corporation, deductions must be based on W2 income. This means that the solo 401(k) must be in place by year end. Contributions from W2 income may be targeted for maximum overall benefit.

Eligible businesses may wish to structure employee year-end bonuses as profit-sharing contributions. This provides a great tax smart benefit to the employee and may enable the business to deduct up to 25% of the total compensation paid during the tax year to all participants.

Women Entrepreneurs and Philanthropists

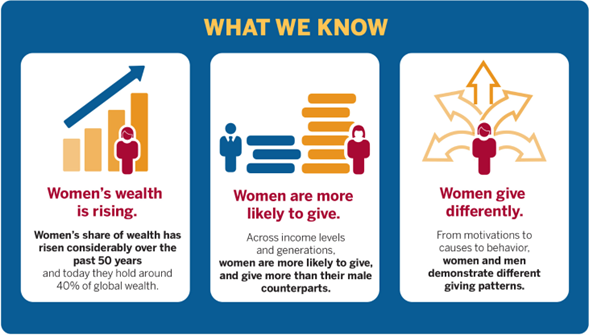

Women are coming more and more into the forefront of charitable giving and philanthropic activity. Recent research from the Women’s Philanthropy Institute (WPI) shows that women are gifting to charity more than ever before. Consider the following facts:

- Women hold around 40% of global wealth today, and their share is rising;

- Women are more likely to give than their male counterparts, especially on Giving Tuesday (this year it’s November 28, 2023);

- Women and men give differently, with women donating more to causes that support women and girls and also tend to give more as part of group initiatives like giving circles;

- According to WPI, most of the high-net-worth female philanthropists in a recent study did not grow up wealthy, but had early experiences with philanthropy and were “taught to give what they could.”

For women entrepreneurs who wish to “do well by doing good,” effective use of charitable initiatives can be an important component of overall tax strategy. Here again, DAFs can provide a useful, convenient way to provide a meaningful gift to one or more charitable causes over time, while shielding the appreciation from taxation and placing the assets in a position for further growth.

High-Net-Worth Family

For high-net worth families with philanthropic goals, gifts of appreciated assets to a DAF can be a wonderful vehicle to initiate meaningful family conversations around philanthropy. For example, such a family could choose to establish a family DAF account and encourage each family member to select a charitable cause of their choice to receive a gift from the fund. Just imagine the conversations that might take place around the Thanksgiving table as family members talk about their chosen charity, its work, and why it is particularly important to them.

In addition to the strategies mentioned above, we have summarized a few additional topics that can help you take advantage of the most common tax smart strategies as you head into the end of the year.

Maximize Retirement Contributions

Review the contributions you have made thus far to your 401(k)s and IRAs to ensure you are maximizing your contributions. This will not only help you in securing a comfortable retirement, but can also lower your taxable income for the current year. The maximum contribution limit is $22,500 for a 401(k) and $6,500 to an IRA with an additional $1,000 catch up contribution if you are over 50. These limits are set to increase to $23,000 and $7,000, respectively in 2024.

Harvest Tax Losses

Review your investment portfolio for underperforming assets, and consider selling investments with losses to offset gains or write off up to $3,000 against ordinary income.

Charitable Contributions

As mentioned above, charitable donations can provide a nice tax benefit while supporting your favorite causes. For your donation to qualify for deductions on your 2023 tax return, contributions must be made before the end of the year. Ensure you keep proper documentation of your contributions for tax filing purposes. If you know that you will be itemizing your deductions this year, then you may consider bunching your charitable contributions to maximize your deductions.

If you are age 70 ½ and older you can take advantage of the qualified charitable distribution (QCD) rule, which allows an IRA owner to gift up to $100,000 to charity directly from their IRA account. The extra benefit of the QCD is that the donation is counted towards your required minimum distributions, and unlike traditional distributions which are taxable the QCD is not included as part of your taxable income.

Gifts and Inheritance Planning

Leverage the annual gift tax exclusion to transfer wealth to your heirs without triggering the gift tax filing rules. The maximum limit for 2023 is $17,000 per beneficiary, which means a couple may gift up to $34,000 to a beneficiary. This limit is expected to increase to $18,000 in 2024.

Review Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA)

If you have an HSA or FSA, review your account balances. Since FSA’s follow a use it or lose it rule, it is especially important to use any remaining funds for eligible medical expenses before the end of the year so that you do not lose it. Some employers may allow you to carry over up to $610 to the next plan year, so it would be best to check with your HR department. You can use your FSA for any qualified medical expenses such as, deductibles and copayments, over the counter medicines, and medical supplies like bandages.

Year-end tax planning is a dynamic process that requires a proactive approach. By taking advantage of the tax savings opportunities mentioned above individuals and businesses can optimize their tax efficiency. Also remember to always consult with a tax professional to ensure compliance with current tax laws.

To learn more about tax efficient strategies using donor-advised funds, creating a personalized gifting strategy, or to discuss how a different type of retirement plan might benefit you, reach out to your Quantum advisor today!

DISCLOSURE: Quantum Financial Advisors, LLC is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Quantum Financial Advisors, LLC by the SEC nor does it indicate that Quantum Financial Advisors, LLC has attained a particular level of skill or ability. This material prepared by Quantum Financial Advisors, LLC is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Advisory services are only offered to clients or prospective clients where Quantum Financial Advisors, LLC and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Quantum Financial Advisors, LLC unless a client service agreement is in place. This material is not intended to serve as personalized tax, legal, and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Quantum Financial Advisors, LLC is not an accounting or legal firm. Please consult with your tax and/or legal professional regarding your specific tax and/or legal situation when determining if any of the mentioned strategies are right for you.

Please Note: Quantum does not make any representations or warranties as to the accuracy, timeliness, suitability, and completeness, or relevance of any information prepared by an unaffiliated third party, whether linked to Quantum’s website or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

For more information about Quantum and this article, please read these important disclosures.

- Financial Planning

- Tax Planning

- Executive Compensation