The Bumpy Road to Long Term Returns

- Note from the CIO

- Investment Management

After enjoying strong returns in the first half of 2023 – a welcome relief from the tough year before – the third quarter was somewhat of a setback for stock market investors. The bond market also gave back some of its gains for the year during the third quarter. It is only human to feel fatigued by the roller coaster ride. But remembering how markets work can help us cope and lead to a successful investment experience.

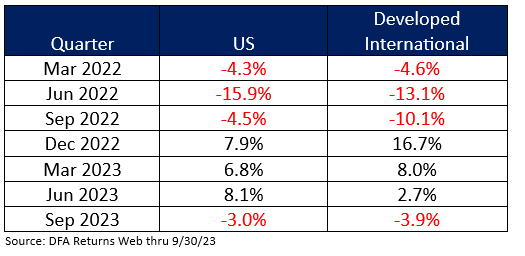

The table below shows the returns by quarter for our two largest equity allocations starting in 2022, clearly illustrating the up and down nature – also known as the “volatility” -- of equity investing.

The challenge with time periods as short as a quarter is that it is nearly impossible to perceive the positive trend line, or expected return, around which these quarterly returns merely oscillate above and below. Even over annual periods, stock market returns appear to be random, with no visible trend. There is a reason for this.

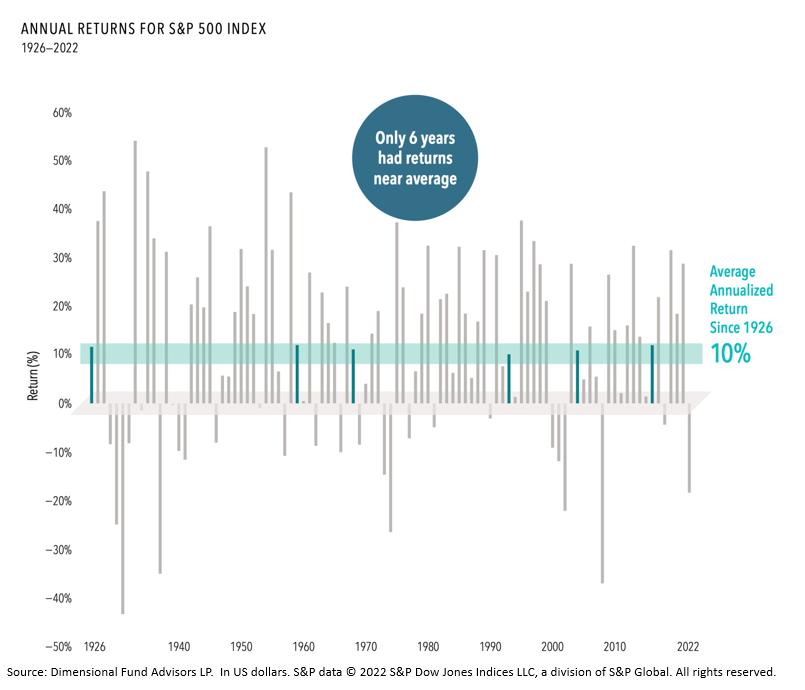

The following remarkable chart, called “The Bumpy Road to the Market’s Long-Term Average”, is updated annually by Dimensional Fund Advisors, and year after year, it provides the same valuable message.

Since 1926, the US stock market has rewarded investors with an annualized return of about 10%. However, returns in any given year may be sky-high, extremely poor, or somewhere in between. For example, yearly returns have ranged as high as up 54% and as low as down 43%.

That’s important, but it is not the main message, which is this: in those 97 years, annual returns came within two percentage points of the market’s long-term average in just six years.

That is why it can seem impossible to see the forest for the trees in investing. In fact, one can feel pretty darn lost, frustrated, or fearful at times in the market without this big-picture perspective that the bumpy road is completely normal and that it masks the truth that we are moving along the expected return trend line. But could it be any other way? If it was clear and easy, always leaving us feeling sure and safe, that we are on a positive return path then everyone would do it and the premiums simply would not exist because there are no free lunches in investing (except for diversification!). The volatility is the admission ticket to good returns over time. Of course, the other key to not being rudderless in the markets is to have a plan and to be acting on it continuously, rather than reacting to the markets. (Apologies for mixing three different metaphors in one paragraph.)

The paradox of stock market investing is that it is so intellectually simple, yet so emotionally difficult. On the one hand, we know from evidence-based research, and even just our life experience, that declines in the market are temporary, while the gains last much longer, are much greater in magnitude, and therefore result in permanent wealth creation. On the other hand, when our stock investments temporarily decline by a third every five years (just to use the average bear market decline and frequency), and financial media is drowning us in doomsday headlines, it is difficult not to feel “this time is different”. But notice, the operative word there was “feel”. By remembering how markets work, we can cope with challenging feelings by knowing that “this too shall pass” and reach our investment goals. And should you still need some reassurance, your Quantum advisor welcomes the opportunity to have that conversation.

DISCLOSURE: Quantum Financial Advisors, LLC is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Quantum Financial Advisors, LLC by the SEC nor does it indicate that Quantum Financial Advisors, LLC has attained a particular level of skill or ability. This material prepared by Quantum Financial Advisors, LLC is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Advisory services are only offered to clients or prospective clients where Quantum Financial Advisors, LLC and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Quantum Financial Advisors, LLC unless a client service agreement is in place. This material is not intended to serve as personalized tax, legal, and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Quantum Financial Advisors, LLC is not an accounting or legal firm. Please consult with your tax and/or legal professional regarding your specific tax and/or legal situation when determining if any of the mentioned strategies are right for you.

Please Note: Quantum does not make any representations or warranties as to the accuracy, timeliness, suitability, and completeness, or relevance of any information prepared by an unaffiliated third party, whether linked to Quantum’s website or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

For more information about Quantum and this article, please read these important disclosures.

- Note from the CIO

- Investment Management

Darius Gagne, PhD, CFP®, CFA

Darius Gagne is the Chief Investment Officer of Quantum Financial Advisors, LLC. Darius is also a Financial Advisor directly to clients and a founding partner of the firm.

Read More