A Really “GRAT” Opportunity

- Financial Planning

- Estate Planning

Many people have heard of Roth IRAs -- accounts in which the earnings on the investments grow income tax-free. Ever wonder if there is an analogous vehicle that is free of estate tax? That is where the Grantor Retained Annuity Trust, or GRAT, comes in. Although commonly considered part of “advanced estate planning,” GRATs are really not that difficult to understand.

Advanced estate planning generally refers to strategies aimed at reducing estate tax, a “problem” that currently only applies to individuals with assets over $12.92 million (the current estate tax exemption) in 2023, or double that amount, $25.84 million, for couples. But it’s important to remember that assets in the estate include homes and real estate as well as investment and retirement accounts. And under current law, the current exemption (which increases each year with inflation) will be cut in half in 2026, since this provision of the Tax Cuts and Jobs Act (TCJA) of 2017 is scheduled to “sunset” at that time. So, estate tax considerations could become a planning concern for more people if that occurs, absent the extension of the higher exemption or the passage of a new law.

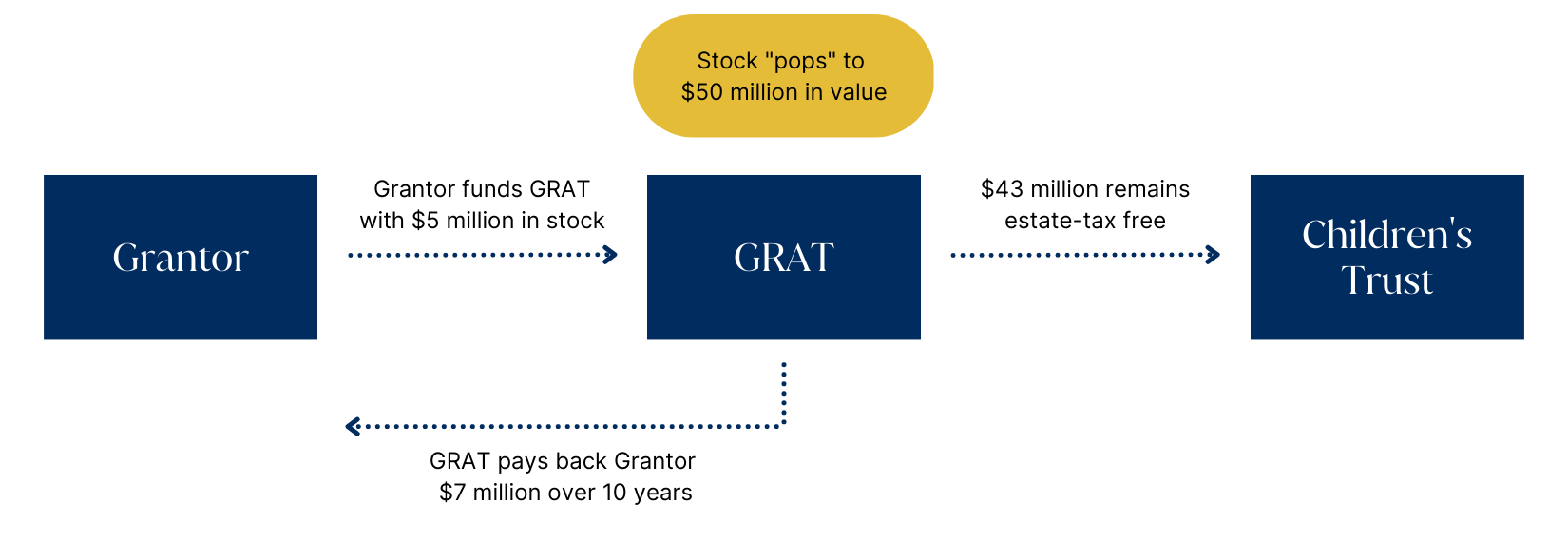

The GRAT vehicle is all about removing future appreciation from the taxable estate. What appreciation is that? This could include increases in market value or earnings from an investment portfolio, or appreciation in other assets, such as real estate. But the situation where a GRAT offers the most bang for the buck is with assets that are expected to highly appreciate, such as shares or options granted in a private company or start-up. For a visual representation of how a GRAT works, consider the following chart.

In this example, the grantor (the person setting up and funding the trust) creates the GRAT with the help of a qualified estate-planning attorney and funds it with $5 million of stock in a start-up company. The start-up does well and goes public, and the value of the shares “pops” to $50 million. The rules for GRATs require that the original funding ($5M), plus interest (currently assumed at around 5%) is paid back to the grantor over the term of the GRAT (which can be anywhere from two to ten years) as an annual annuity. In this example, the total interest over a ten-year GRAT would be about $2 million. This leaves $43 million left in the GRAT at the end of the ten-year term. At that point, the GRAT typically distributes all its remaining assets to “remainder” trusts for children or other heirs. As long as you outlive the GRAT, these final trusts are free of estate tax upon your death and potentially upon the death of future generations.

In a nutshell, if you have an asset that you expect to appreciate significantly over the next two to ten years, and your financial plan says that you will not need access to that appreciation because the current value of this asset (without the expected appreciation) combined with all your other assets is enough to cover your lifetime goals, then utilizing a GRAT could shelter a significant amount of wealth from estate tax. It is important to emphasize here that the GRAT does not make the original asset value free of estate tax. That value (plus the interest paid by the GRAT to the grantor), is always considered part of the estate. So, the GRAT only removes the appreciation (in excess of the threshold interest rate) on the asset from the estate. But it is not uncommon for individuals to transfer shares in a private company to a GRAT and that company to subsequently have a liquidity event (for example, an initial public offering (IPO) or an acquisition), such that the value of the shares increases (“pops”) by many multiples, essentially dwarfing the value of the original shares.

It should be noted that if any gains on the assets in the GRAT are realized (meaning that investments held by the trust are sold at a profit) then this gain will be subject to income tax (capital gains tax in particular). The “grantor” part of the GRAT acronym has several implications, including the fact that the income tax from the assets in the GRAT will be reported on the tax return of the grantor (the person who set up the GRAT and who owned the assets that went into it). So, while the GRAT results in estate-tax-free treatment of the appreciation of the assets, it does not (nor does any subsequent remainder trust funded by the GRAT) result in income-tax-free treatment. Conversely, while withdrawals from a Roth IRA enjoy income tax-free treatment, the account is not free of estate tax.

You might be wondering why anyone would sell the appreciated assets in the GRAT and subject themselves to potentially millions of dollars of capital gains tax. In the case of a private company going public where the assets in the trust exhibit a significant increase in value, it would create a major concentrated asset as part of the investor’s overall net worth. Prudent financial planning in most cases would suggest diversifying the investment as soon as possible, even at the cost of paying capital gains taxes, not just because the “pop” could be temporary, but because any single company, especially a new and still relatively small company (despite going public), is subject to all sorts of idiosyncratic risks that investors may not be compensated for.

As a fiduciary wealth manager, Quantum Financial Advisors’ chief priority is the best interest of our clients. Whether you are concerned mainly with creating a personalized plan for growing your current wealth or with ensuring the benefit of future generations, we can help you design a strategy to accomplish your most important goals. To learn more, click here to read our article, “Beyond the Red Envelope: Multi-Generational Wealth Transfer Strategies.”

DISCLOSURE: Quantum Financial Advisors, LLC is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Quantum Financial Advisors, LLC by the SEC nor does it indicate that Quantum Financial Advisors, LLC has attained a particular level of skill or ability. This material prepared by Quantum Financial Advisors, LLC is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Advisory services are only offered to clients or prospective clients where Quantum Financial Advisors, LLC and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Quantum Financial Advisors, LLC unless a client service agreement is in place. This material is not intended to serve as personalized tax, legal, and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Quantum Financial Advisors, LLC is not an accounting or legal firm. Please consult with your tax and/or legal professional regarding your specific tax and/or legal situation when determining if any of the mentioned strategies are right for you.

Please Note: Quantum does not make any representations or warranties as to the accuracy, timeliness, suitability, and completeness, or relevance of any information prepared by an unaffiliated third party, whether linked to Quantum’s website or blog or incorporated herein, and takes no responsibility for any such content. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

For more information about Quantum and this article, please read these important disclosures.

- Financial Planning

- Estate Planning

Darius Gagne, PhD, CFP®, CFA

Darius Gagne is the Chief Investment Officer of Quantum Financial Advisors, LLC. Darius is also a Financial Advisor directly to clients and a founding partner of the firm.

Read More